Secure Display

Concept definition

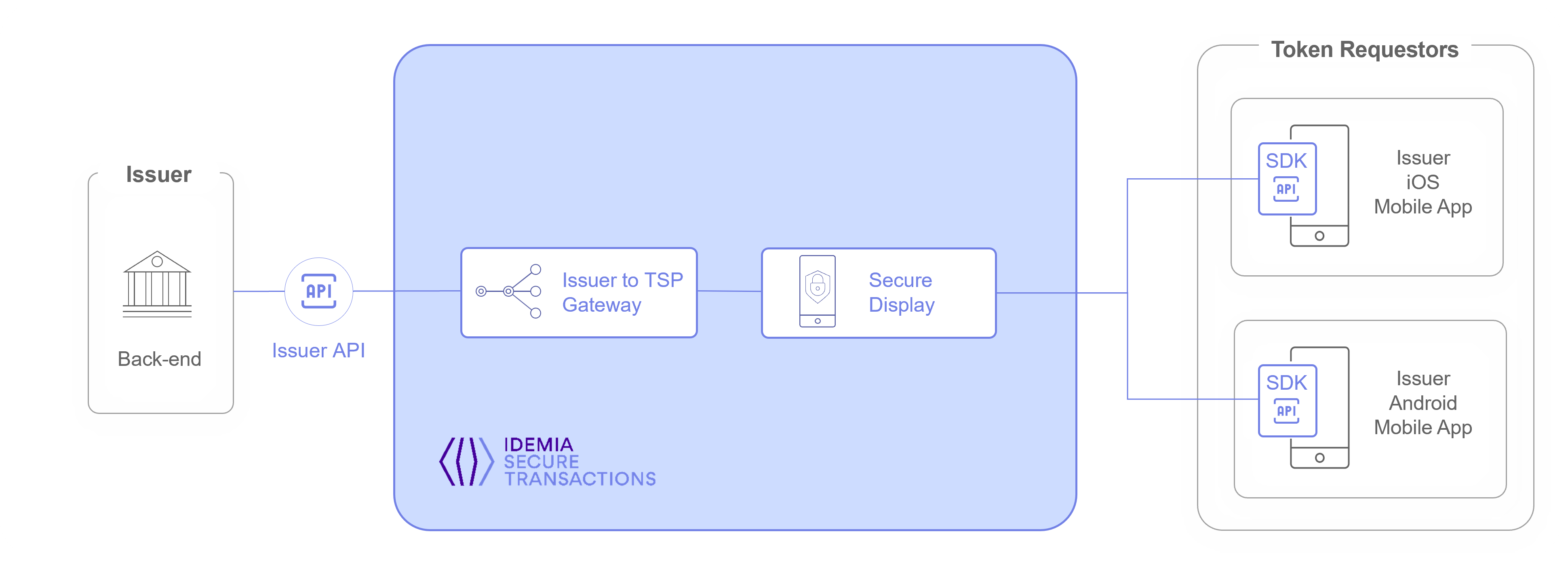

The IDEMIA Secure Display service enables card issuers to securely display sensitive card-related data (card data or PIN code) from the issuer’s mobile app. IDEMIA provides easy to integrate APIs and an Android/iOS SDK to securely transfer sensitive information between the issuer’s back-end and a mobile app and securely display it to share it with consumers.

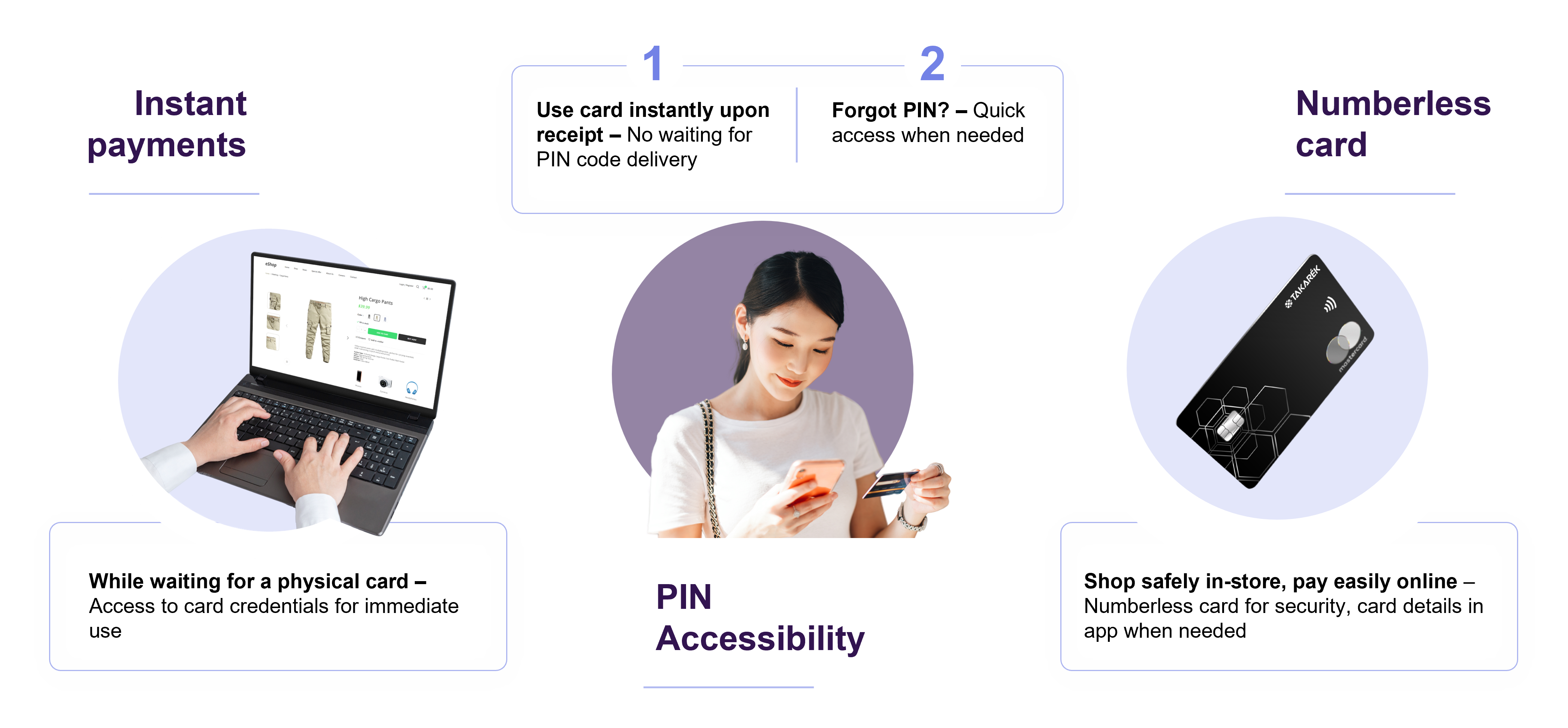

Use Cases

The IDEMIA Secure Display service covers the following use cases:

Instant payment access

card details can be shared immediately after opening an account or applying for a credit line, allowing consumers to start paying before their physical card arrives.

PIN accessibility

the PIN associated with a physical card can be generated, shared for the first time, or displayed on demand within the issuer’s mobile app.

Numberless cards

for cards without printed details, Secure Display allows consumers to access their card information in-app, enabling online shopping whenever needed.

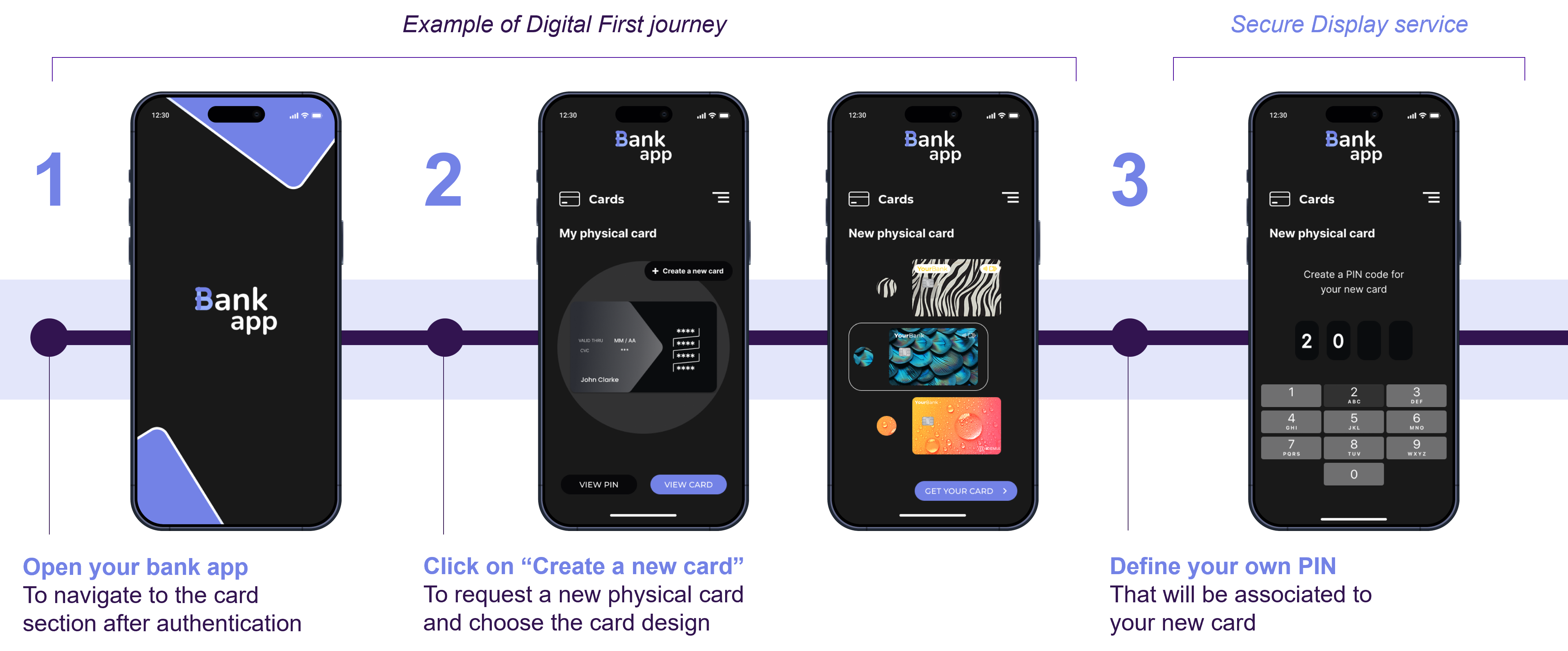

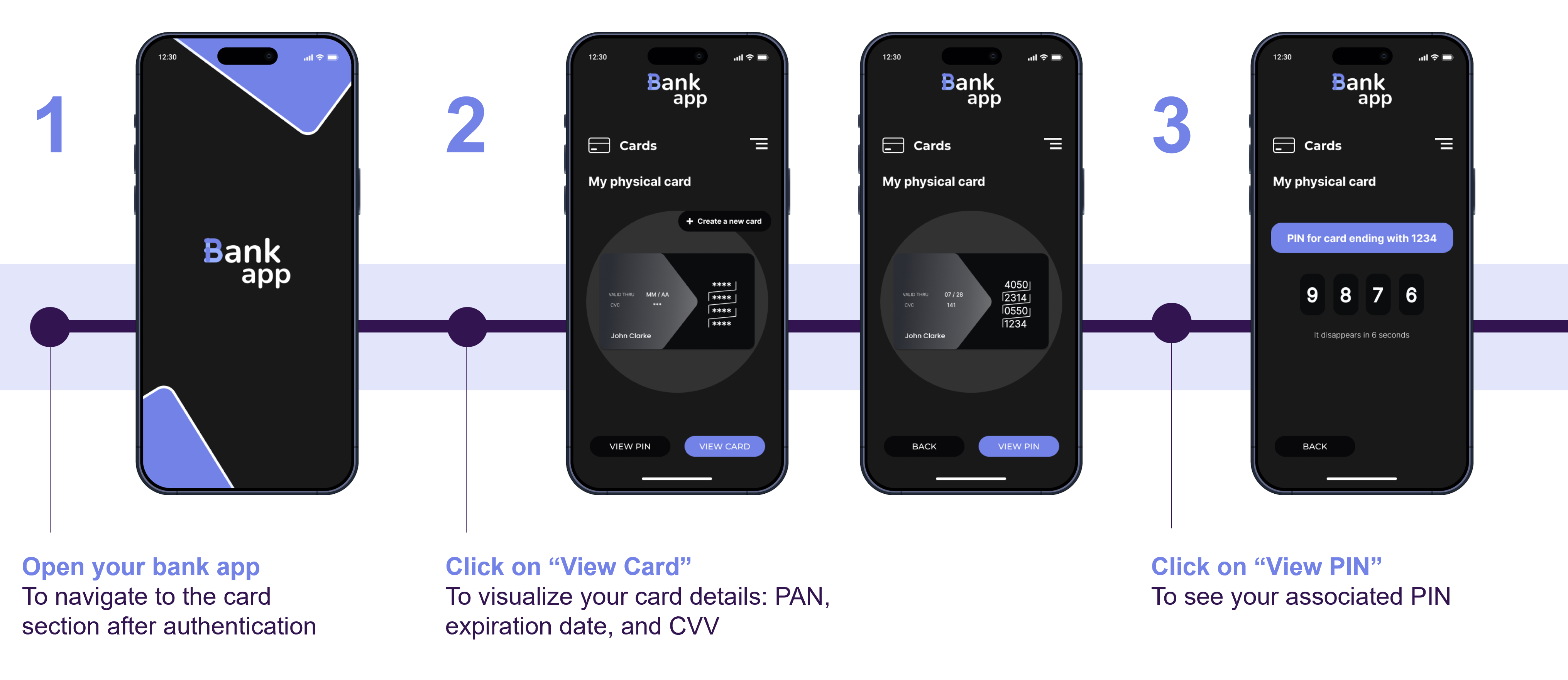

User Experience

Display of PAN, exp date, CVV of the card and PIN

PIN generation during a new card request

Key features

Security is a paramount

-

EMV & PCI-DSS compliant: built to meet industry security standards.

-

End-to-end encryption no sensitive card data is stored.

-

Secure display for a limited time: shows payment data only after local authentication (CDCVM).

-

Device binding adds an extra layer of protection at first app launch.

-

Screenshot protection: prevents capturing sensitive data.

-

Customizable card display generate a transparent card image to match the app’s design.

-

IN & CVV generation: display card security codes as needed.

-

PAN copy & paste: consumers can copy the card number from the display into merchant checkout fields.

Service Benefits

-

Elevated brand reputation Strengthens consumer trust and engagement.

-

Digital capabilities for consumers: 82% of consumers value instant card display for online payments, and 93% want the ability to retrieve or change their PIN.

-

Cost efficiency: Reduces card reprints and PIN delivery costs by minimizing reprints, replacements, and call center requests.

-

Security compliance: Provides end-to-end protection while keeping the mobile app outside PCI-DSS scope.

Integration overview

To enable IDEMIA Secure Display, the issuer connects the service through two endpoints:

-

Back-end integration: Connect IDEMIA Issuer API with the Card Management System. This can also be done via the issuer’s processor.

-

Mobile integration: Embed IDEMIA mobile SDK, compatible with Android 12+ and iOS 15+, directly into the issuer’s mobile app.