Virtual Card

Concept definition

Virtual Cards, also known as Virtual Card Numbers (VCN), bring cardholders instant, secure, and flexible payment capabilities directly within their digital banking app. Instantly issued and protected by strong authentication, they give consumers immediate access to online payments while reducing fraud risk.

For issuers, Virtual Cards extend the value of physical cards into the digital space, blending real-time availability with smartphone-driven interactivity to deliver a seamless, modern payment experience.

The IDEMIA Virtual Card Service provides on-demand generation and verification of reusable or single-use cards, ready for secure e-commerce transactions. It can also be paired with the IDEMIA Secure Display Service, ensuring sensitive card details are safely displayed inside the issuer’s mobile app.

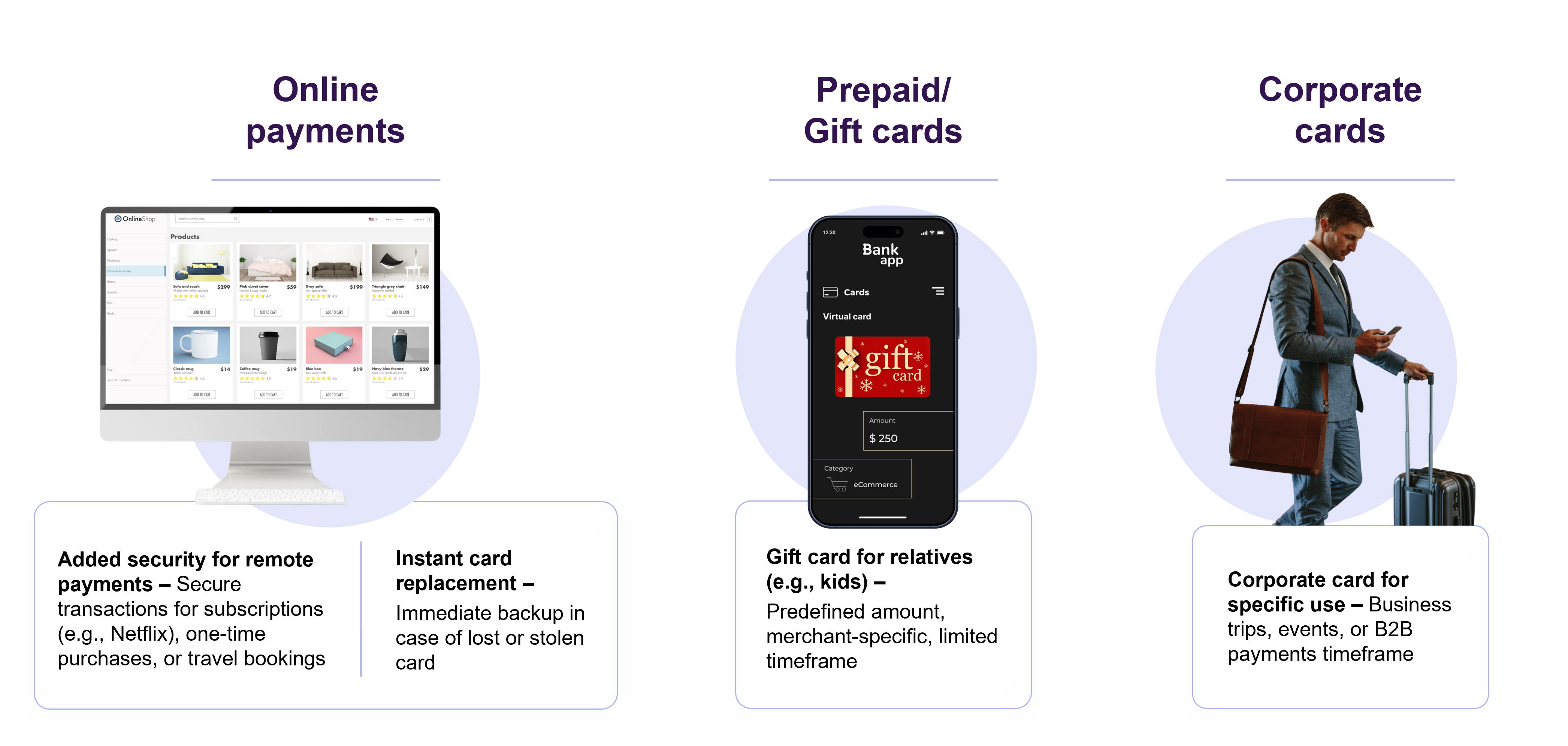

Use Cases

The IDEMIA Virtual Card service covers the following use cases:

-

Instant payment access – card details can be shared immediately after opening an account or applying for a credit line, allowing consumers to start paying before their physical card arrives.

-

PIN accessibility – the PIN associated with a physical card can be generated, shared for the first time, or displayed on demand within the issuer’s mobile app.

-

Numberless cards – for cards without printed details, Secure Display allows consumers to access their card information in-app, enabling online shopping whenever needed.

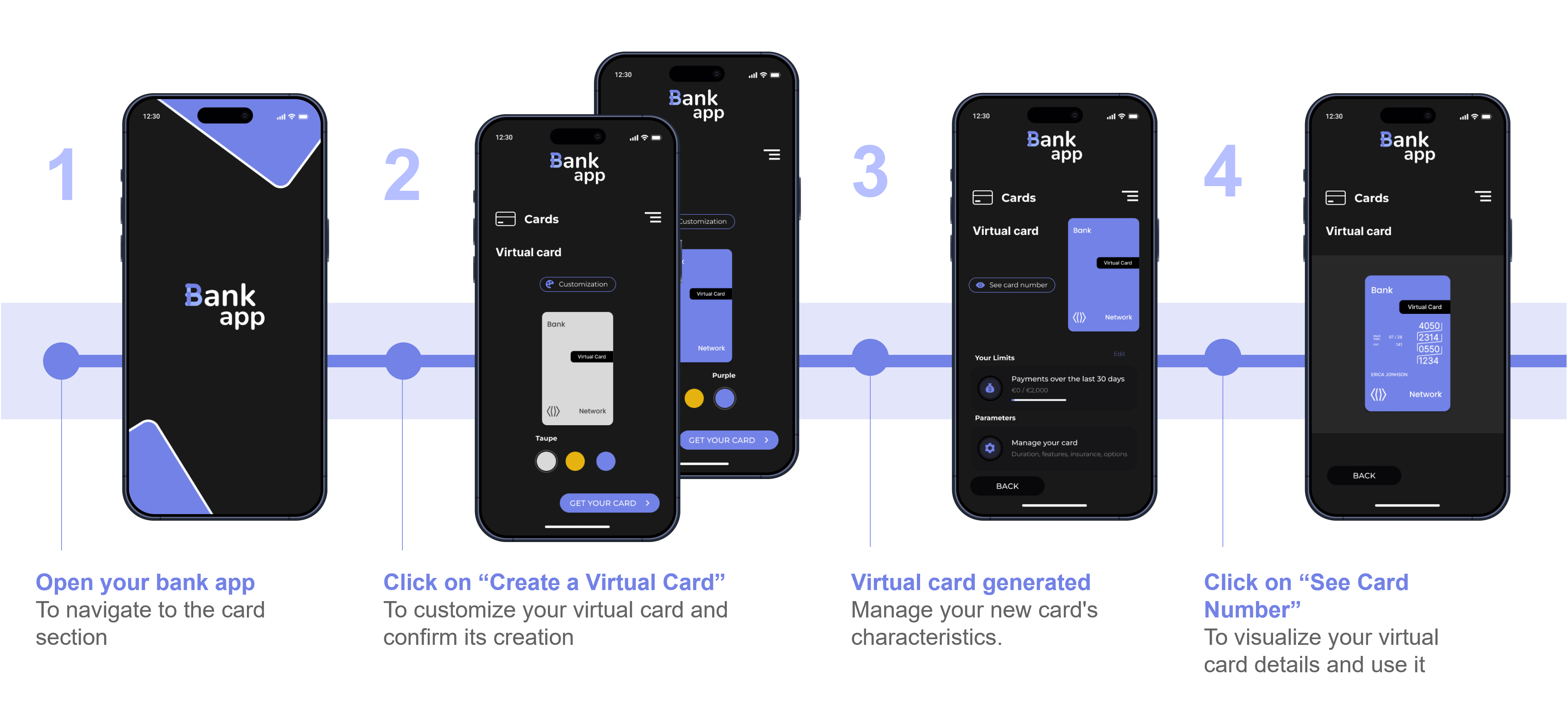

User Experience

Creation of a virtual card for eCommerce payments

Online payments

For eCommerce purchases, consumers can use the virtual card just like a physical one, by entering the PAN, expiry date, and CVV at checkout

Key features

Virtual card data type configurations

Card issuers can select the format for the alternate data to be generated by the IDEMIA Virtual Card service. It includes the card data (token PAN, expiration date, CVV) or the dynamic CVV only.

Domain and usage parameters

Service Benefits

The IDEMIA Secure Display service provides issuers with the following benefits:

- End-to-end security service to avoid issuer’s mobile app to be under PCI-DSS constraints,

- Improving security and trust by relying on sensitive card-related data display, putting the cardholder “in control”,

- The unmatched immediacy and convenience of displaying securely card related data such as card number or PIN number creates a unique set of benefits, fostering client satisfaction, boosting customer acquisition and retention,

- Consumers can immediately start accessing payment credentials for online payments after onboarding or in case of lost or stolen physical card. The result? This continuous access to a payment means is a great way to customer satisfaction,

- Easy to integrate set of APIs and mobile SDK.

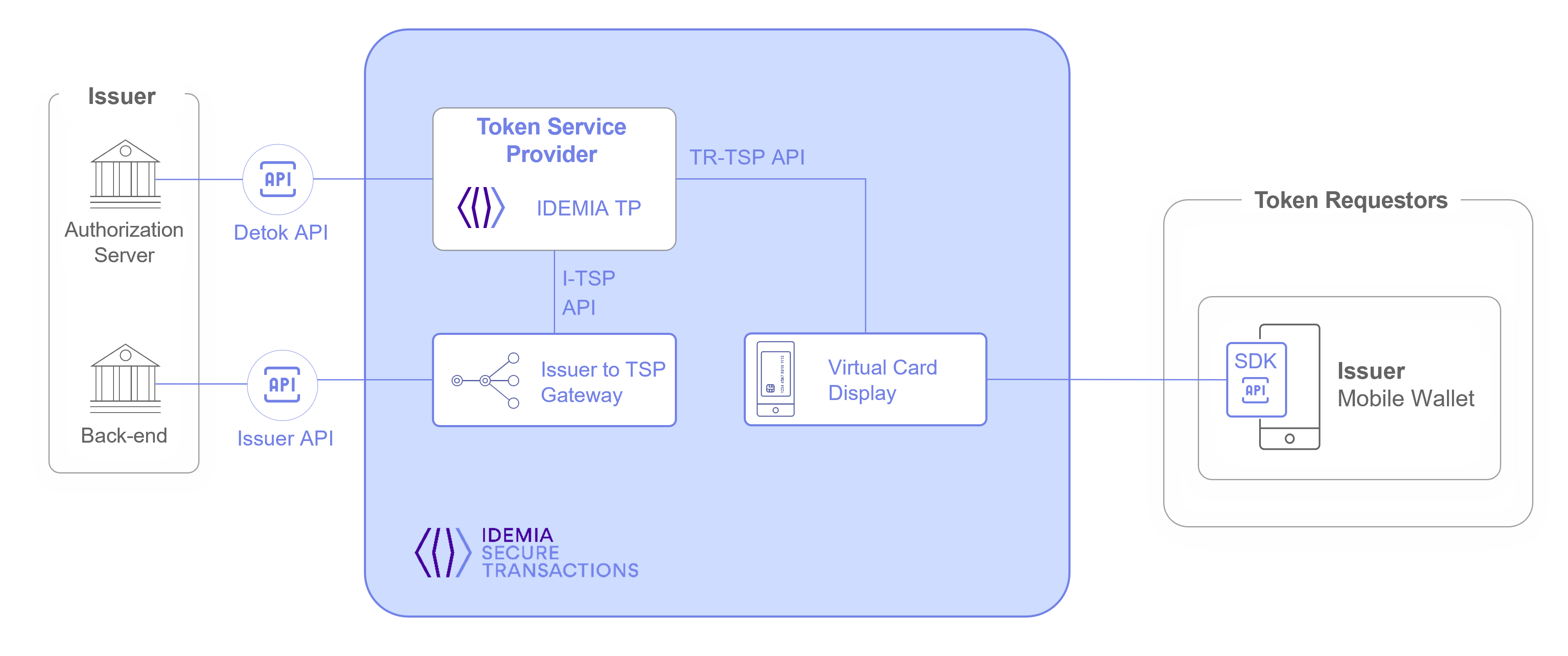

Integration overview

To enable IDEMIA Secure Display, the issuer connects the service through two endpoints:

- Back-end integration: Connect IDEMIA Issuer API with the Card Management System. This can also be done via the issuer’s processor.

- Authorization integration: Connect the issuer’s authorization/processing server to the IDEMIA Detokenization API.

If the IDEMIA Virtual Card Service is not combined with the IDEMIA Secure Display service, IDEMIA will integrate with the issuer wallet and display provider via the IDEMIA TR API.